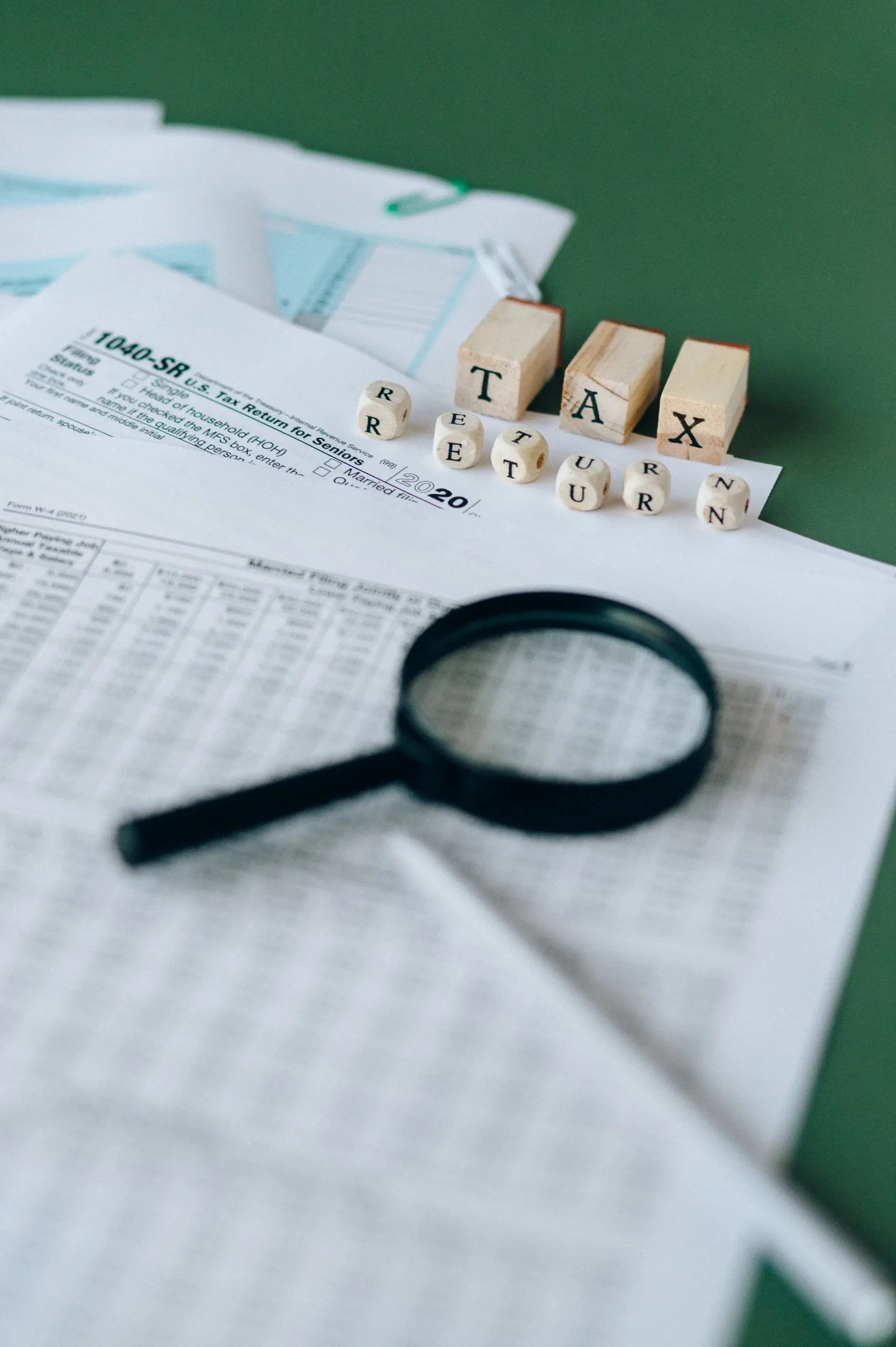

Accounting, Taxation & Payroll Processing Services refer to a range of professional services provided by accounting firms or specialized firms that assist businesses and individuals in managing their financial records.

- Malonda Johan & Co

-

Mon - Fri: 8:00 AM - 5:00 PM

-

jmsby@malondajohan.com